How To Change Language In Income Tax Website

Filing your income tax return (ITR) is a way to inform the government about the incomes you have earned during a financial year. There are different ITR forms and you should know which one you should file. One of the forms used by salaried taxpayers is ITR-1. So, to begin with, you need to check if you are eligible to file ITR -1 form. After that you need to collect all the documents and information you need to file your return.

This is the first in a series of articles that will tell you all you need to know to file your ITR1 for FY2017-18. In this story, we will talk about how to file ITR1 online.

Also read: How to prepare to file ITR 1

- Online vs offline

There are two options to fill ITR 1: taking the online route via the income tax e-filing website or by downloading the form in excel/java format onto your laptop and then filling it offline. The form to be filled is similar in both cases. Only the procedure of filing the return is different.

The income tax department has asked more details from salaried taxpayers in this year's ITR form-1 as compared to last year. These details include providing a break-up of salary and income from house property. To start filing ITR-1, you must be registered on the income tax e-filing site. Click here to know how to register yourself on the income tax e-filing website and how to access your account through net banking.

Once you have registered yourself on www.incometaxindiaefiling.gov.in, then you can follow the steps below to fill and file ITR-1.

Steps to fill and file ITR completely online:

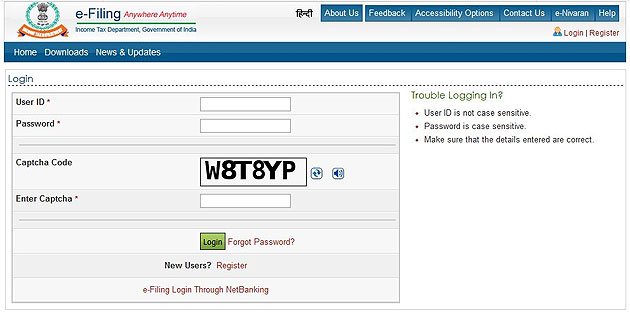

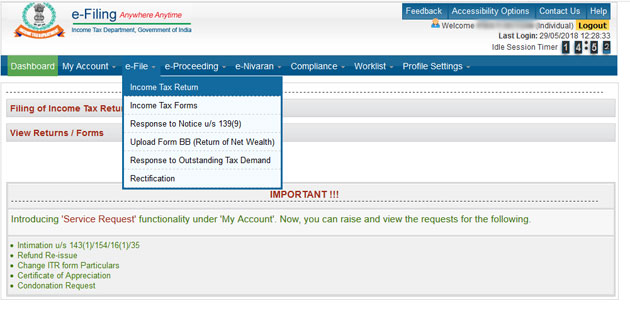

1. Visit www.incometaxindiaefiling.gov.in. Click on login and enter required details: your PAN, password and captcha code. Click on the log-in button. Once you have successfully logged in to your account, click on e-file and select 'Income Tax Return'.

ET Online

ET Online

2. A new window will appear on your screen. Your PAN will be pre-filled. You will be required to choose the assessment year (which is 2018-19 for FY2017-18) from the drop down menu, ITR-1 for the ITR form name and submission mode 'Prepare and submit online'.

3. At this juncture, you will be required to choose how you wish to verify your ITR after filing it, i.e., via Aadhaar or EVC generated by net-banking or sending ITR-V to Central Processing Centre, Bengaluru. Even though verification is the last step in completing the tax return filing process, you cannot skip this step now.

If you wish to file ITR using form in Hindi, then select the box for Hindi. Ignore if you wish to file your ITR using form in English language and click on Submit.

Once submitted, read the general instructions carefully and click on the green arrow on the right- hand corner of the page to start e-filing your ITR completely online.

There are seven steps in ITR filing:

a) General information

b) Income details

c) Details of deductions

d) Calculation of income tax

e) Details of TDS and taxes paid

f) Bank details

g) Verification

Let us look at how to fill in details in each part of the Form

Part A: General information in ITR-1

Part A of the form requires you to fill in general details such as name, surname, PAN number and other details. Filling Part A looks easy but it requires you to have some amount of knowledge about tax rules/laws. Some of the information such as your name, date of birth, email ID and other details will be automatically pre-filled online. You can edit some details like your addresses, email ID, and mobile number.

Fill in other basic details such as Aadhaar number, your employer category from the drop-down menu and check that all the details mentioned in Part-A of the form are correct. According to current laws, providing Aadhaar details is mandatory to file your ITR. Without Aadhaar you cannot file your ITR. In case you have applied for Aadhaar but are yet to receive it, you will be required to provide enrolment ID.

As you are filing the return for the first time in the financial year and before the deadline of July 31, 2018, your ITR will be filed as 'Original' under section 139(1). However, do ensure that '11 - on or before due date 139(1)' is showing in the form as these will be automatically selected.

On the other hand, if you have made a mistake and have to file a revised return, then you will have to choose code '17- Revised 139 (5)' and select 'Revised return'. You will have to provide additional details such as date of filing original return and original acknowledgement number.

If you file the return after the due date, i.e., July 31, 2018, then you would be required to select option '12- After Due Date 139(4)'.

Click on save draft to see if you have correctly filled in all the information required.

Once you have filled, verified and saved the information as draft in Part-A, click on 'Income details' to fill in next section of the form.

In part 2 you will have to give details about details about your income that you have earned during the year. This will include income from salary, house property and so on. Click here to know how to fill salary income details in ITR1 for FY 2017-18.

(Your legal guide on estate planning, inheritance, will and more.

All you need to know about ITR filing for FY 2020-21.)

Download The Economic Times News App to get Daily Market Updates & Live Business News.

How To Change Language In Income Tax Website

Source: https://m.economictimes.com/wealth/tax/how-to-file-itr-1-online-for-fy-2017-18/articleshow/64413561.cms

Posted by: woodsefuldsider.blogspot.com

0 Response to "How To Change Language In Income Tax Website"

Post a Comment